So there are only so many ways to get money for your business, this part shouldn’t be complicated. I feel people overthink this part (I have at least), and I think if you’ve never ran a business before like me, the simpler you keep it, the better. Everyone thinks different, so you have to learn things in your own way, and each person has their own way of doing things.

What I do know is that I have set my own rules and I don’t borrow money any longer.

Paying for Trial and Error

The one exception would be for my home, and I do intend on paying that off. My personal level of income hasn’t been high enough to outrun any ignorant choices the I have made in business, and if you don’t have enough liquid cash to experiment a lot and/or you don’t know what kind of business person you are, then everything feels like a risk. I was in the dark about so much. So, for me, it took simple trial-and-error and learning from me own experiences and that is a high price to pay. One that I didn’t want to pay interest on. When you borrow money you have cash in hand. You can trial and error, and make mistakes fast, and if you’re smart in business perhaps even correct those mistakes and become profitable with other people’s money.

?Know Your Numbers

However because that borrowed money softens the short term blow financially, because it’s not from your own back pocket, some business owners may not be aware of the potential downfalls that are occurring.

That’s why I am choosing to take the longer route and fund everything on my own. It is painfully slow, but I see now that inaction and indecision is also equally causing me in the short-term more on that later.

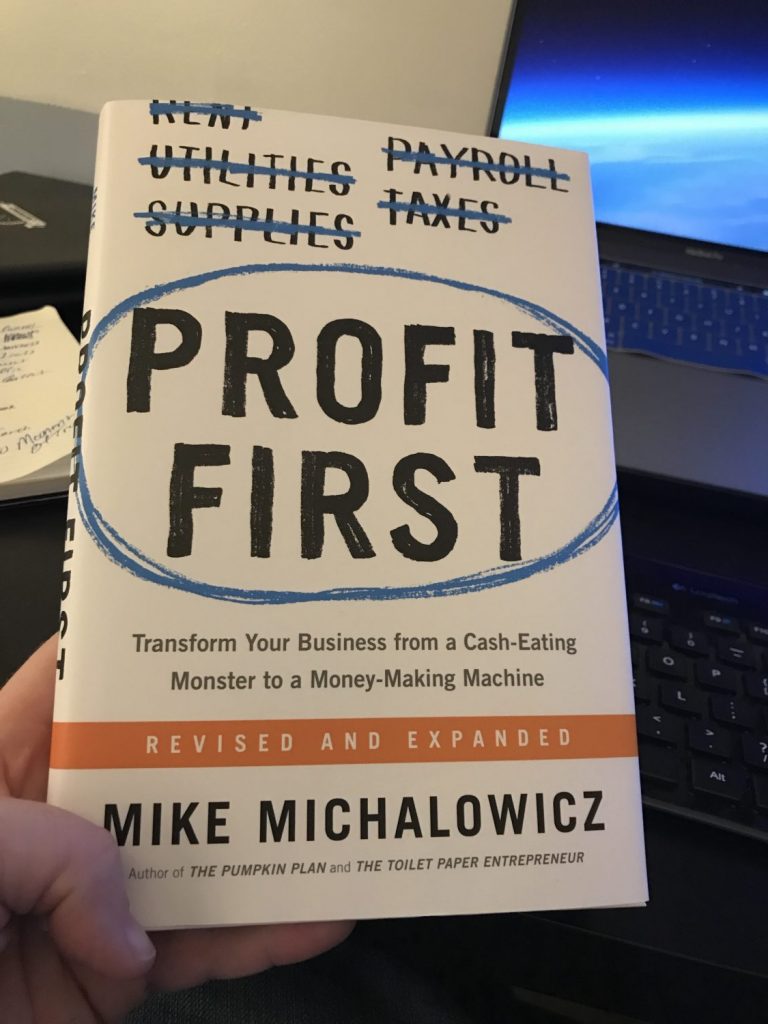

Profit First

I recently listened to an episode of the Ray Edwards show where he interviews Mike Michalowicz about his new book Profit First. This book I will be reading, implementing, and then reviewing soon. You don’t need to wait, you can listen to it here.

Based on living a debt free life style the past few years, I think Profit first has the right mindset for me to be able to structure my business and avoid the pitfalls that I commonly run into. At the very least I think I will get some good nuggets from the book.

Have you read Profit First? Have you successfully been able to fund your own business with out borrowing the money? Let me know how you did it? Did it take a long time? Were you able to hustle through it? I would like to hear your story.